Standing Apart

Our relationship approach delivers the lower middle-market a consistent, reliable lender with scale. Over $5.4 billion committed since inception with vast majority committed to companies with less than $15 million of EBITDA at initial close.

We are a direct lender

At elevation, the “tree line” marks a change of environment.

It is the point at which one must determine to ascend and assume risk or descend and take shelter.

We understand businesses are constantly required to calculate risk. It is critical for businesses to have a lending partner that they can rely on when uncertain conditions exist. Tree Line’s Principals are experienced direct lenders having navigated multiple economic cycles with borrowers. Operators, management teams and sponsors choose to work with us because they know they can count on us when it matters most.

- Founded in 2014

- 100% focus on lower middle-market

- Team has been direct lending since 2002

- Diversified institutional capital base

As a cycle-tested team of direct lenders we understand the needs of lower middle-market sponsors and borrowers. Our streamlined underwriting approach delivers direct access to our decision makers and a relationship they can rely upon.

We understand relationship lending.

Borrowers and sponsors are choosing Tree Line on a repeat basis for a reason.

BY THE NUMBERS

$4.4B

Assets under management

$5.4B

Commitments issued

415

Transactions closed

Agent or lead deal arranger

Repeat & referral deal flow

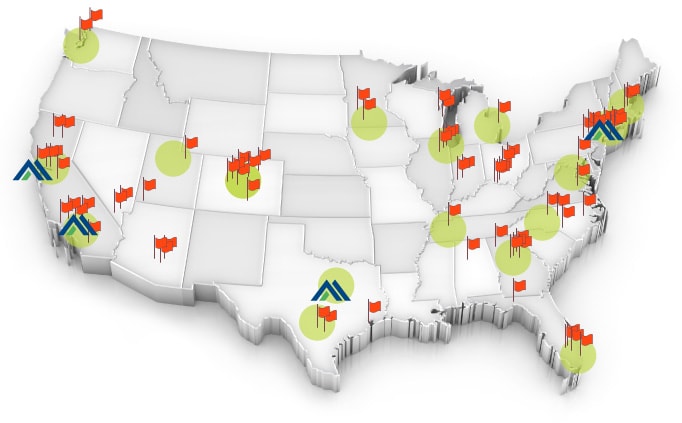

We’ve built a national footprint to deliver tailored financing solutions coast to coast.

18

Sponsor markets covered

3K+

Deals sourced

Tree Line Office Portfolio company

SAN FRANCISCO

NEW YORK

LOS ANGELES

AUSTIN

We deliver flexible financing solutions tailored to meet a company’s needs.

Underwriting Process

SCREEN

- Listen to and understand the needs and goals of the financing

- Provide quick and reliable pricing and structuring feedback

- Term sheets delivered with certainty to close given upfront diligence and direct Investment Committee Involvement

COLLABORATE

- Partner with our borrowers and sponsors to complete business due diligence

- Design creative financing solutions to support post-close acquisition, earn-outs and other needs

- Finalize delayed draws, earn out financing and other custom features to support growth post-close

GROW

- Implement efficient documentation and funding process

- Deliver significant post-close support via ability to grow credit facilities to $100m+

- Maintain flexible approach as a non-bank lender

- Adapt to changing market conditions and provide thoughtful solutions in various lending climates

Our investment criteria is designed to be flexible and adaptive to market conditions.

DEAL SIZE

$10–150 MILLION

OWNERSHIP

Sponsored

Non-Sponsored

Family Office

Independent Sponsor

EBITDA

$5–30 MILLION

SECURITY TYPE

Senior Secured Term Loan

Unitranche Term Loan

Equity Co-Investments