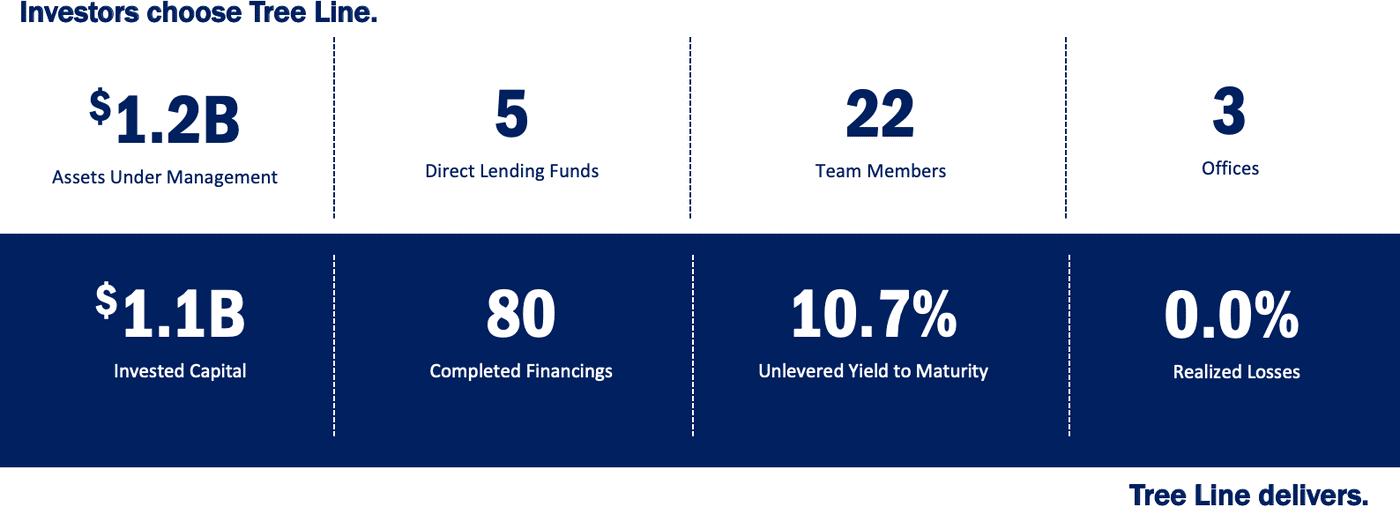

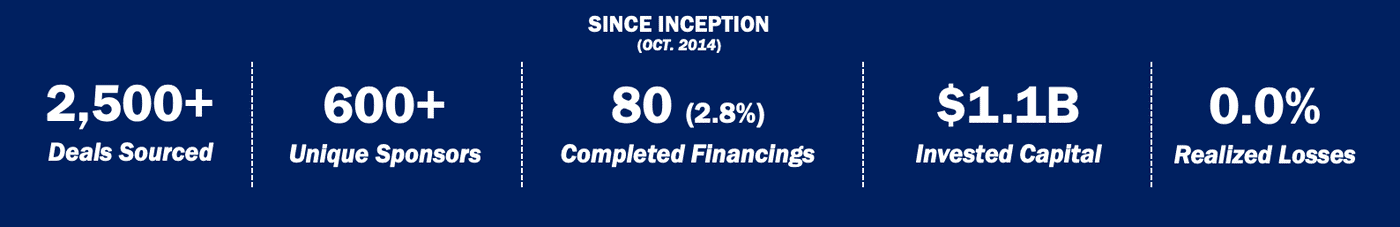

By the numbers.

(As of June 2019)

To our investors,

Without you, none of this would be possible.

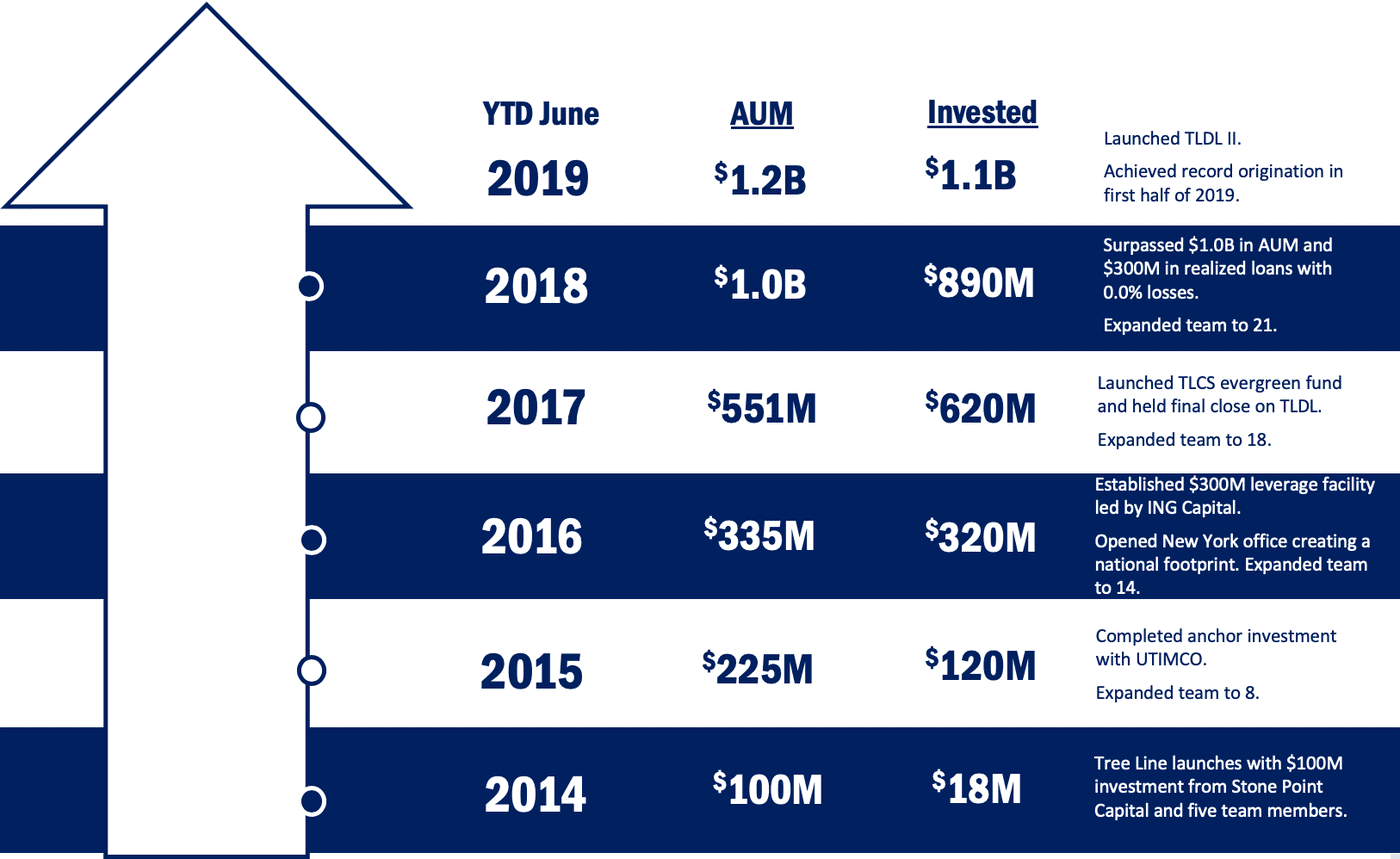

2018 marked the fifth year of operations at Tree Line Capital Partners, and we are proud of the continued progress our firm has made to become a clear leader in lower middle-market direct lending. Our aim has been, and will continue to be, to deliver our investors access to the lower middle-market through our platform and career-long relationships that have been built and nurtured over nearly 20 years.

As we evaluate the state of our market, platform and performance in this Annual Report, we will highlight the value and discipline that exists in our portfolio and strategy. Amidst a chorus of voices concerned about private credit trends, the lower middle-market opportunity remains stable and consistent as it simply is overlooked and underserved. Our sponsors and borrowers truly value our relationship approach and the results are clear.

Understanding private credit.

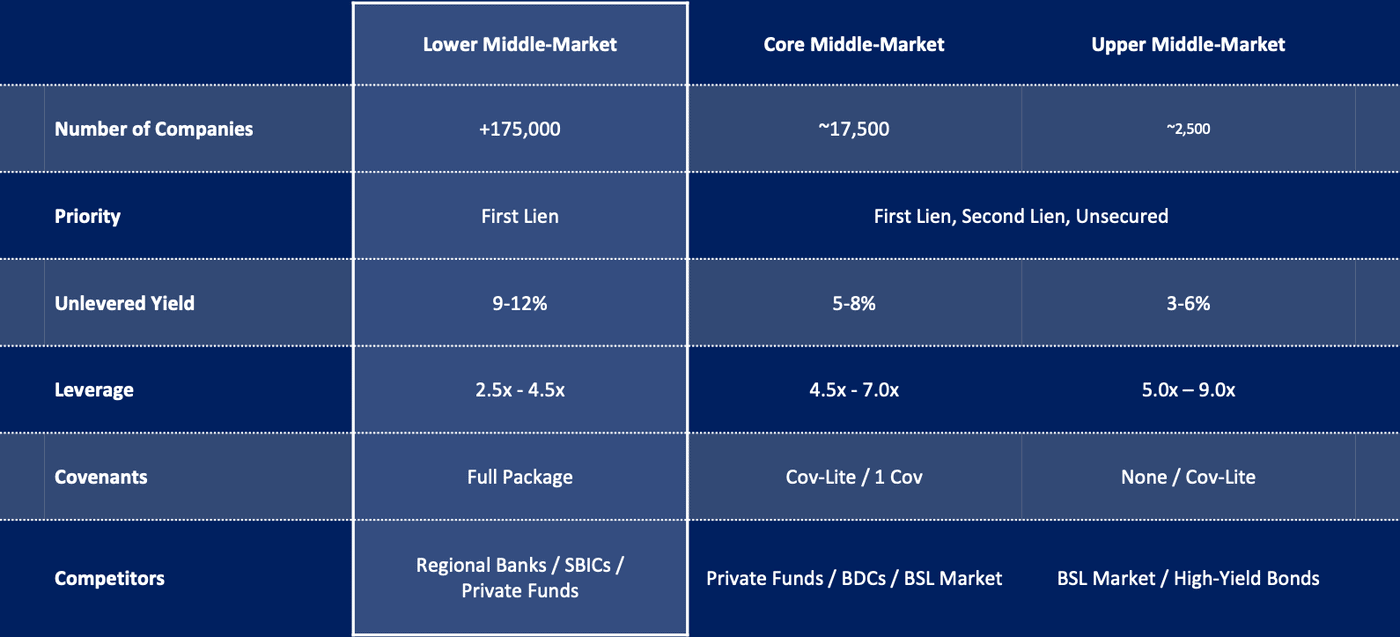

As we evaluate where we stand today with $1.2B in assets under management across five direct lending funds, our niche strategy and market continue to enjoy many constants in a world that is anything but certain. We have been direct lending since 2002 and have endured market cycles, product changes and an influx of capital that has propelled private credit into a mature asset class. Understanding Private Credit is more important now than ever. The asset class has evolved to a point where one must segment the market to fully understand the underlying opportunities and risks which exist for investors. There are stark differences between the trends of the syndicated loan market, the broader middle-market and the lower middle-market. We continue to lead this conversation with investors sharing our expertise and research on the lower middle-market opportunity.

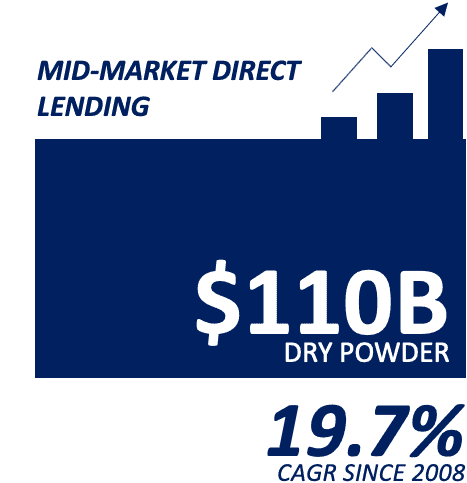

The lower middle-market has provided Tree Line an opportunity to deploy our investors’ capital in senior secured loans with outsized returns and favorable structures. While we observe record capital inflows focused on the upper end of the private credit market to keep pace with the $280B of dry powder on private equity balance sheets, direct lending in the lower middle-market remains overlooked presenting a unique opportunity to those willing to evaluate it.

Expanding our footprint.

The size of the lower middle-market, consisting of 175,000 companies with between $10 and $100 million in revenue, is attracting significant private equity attention. We continue to capitalize on this trend and have been Expanding Our Footprint. Year after year the Tree Line brand gains momentum and awareness as a leader in lower middle-market direct lending. To date, we have deployed over $1.1 billion across 80 transactions and have yet to lose a single dollar of principal.

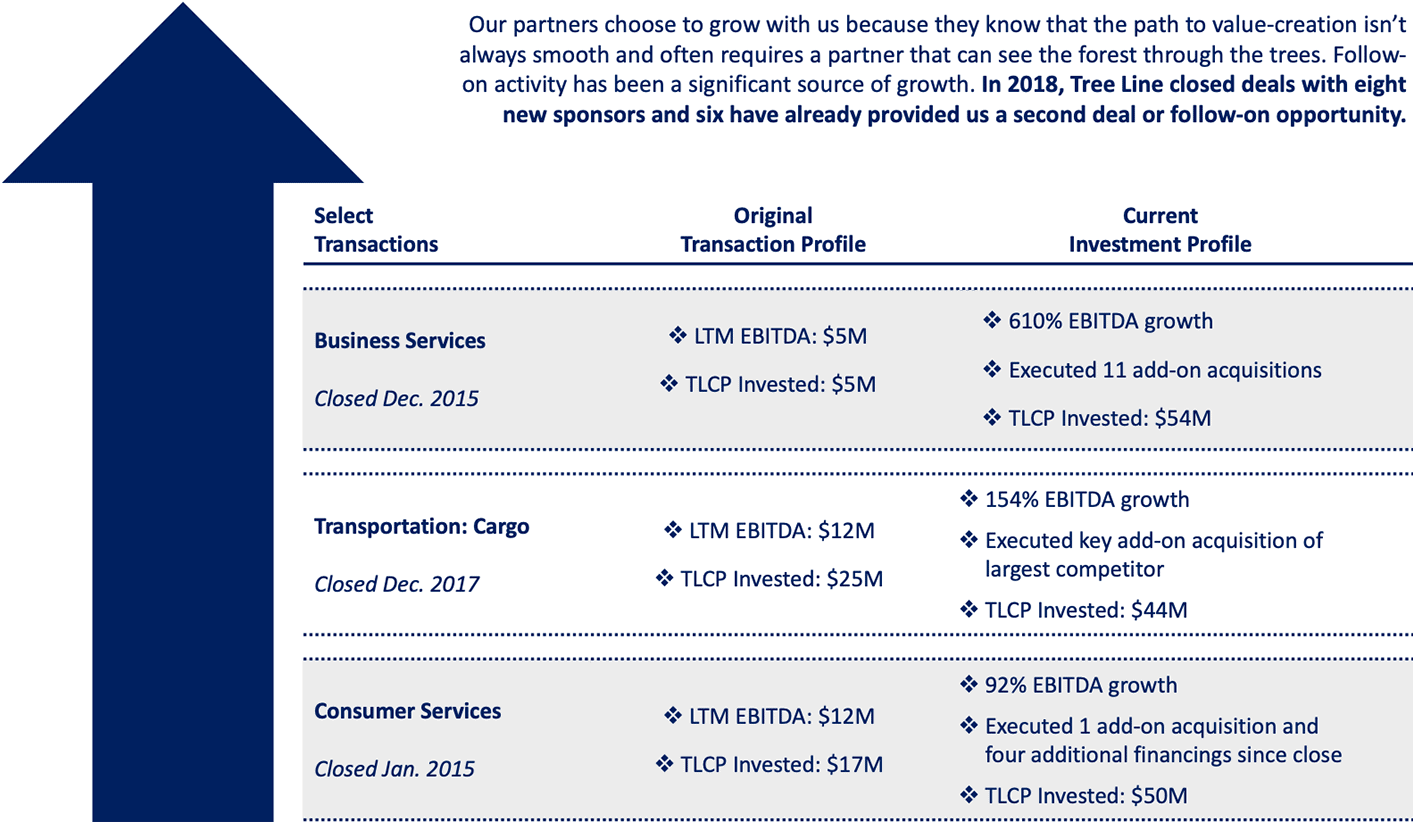

We are the Administrative Agent and/or Lead Arranger on 99% of the deals in our $752M existing portfolio. The Tree Line brand and relationship approach is second to none. Of the capital we have invested to date, 70% has been the result of a repeat or referral relationship. Our borrowers and sponsors choose to work with us, often on a repeat basis, given our long-standing relationships, market reputation for reliable execution and creative credit solutions.

In a highly fragmented competitive environment, Tree Line maintains an advantage over regulated banks, SBIC funds limited by their size, and traditional middle market funds predominantly focused on larger deals. Our unique ability to support a sponsor’s acquisition in the lower middle-market combined with the ability to provide material follow-on financing is a true differentiator.

Preparing for a recession.

Amidst all the activity in private credit 10 years into a recovery, the most common question we hear when talking to investors is how will our portfolio fare in the face of a recession. Won’t lower middle-market companies fall on harder times? Aren’t they less likely to survive a downturn? Shouldn’t I look to invest in a portfolio of companies with EBITDA greater than $50M?

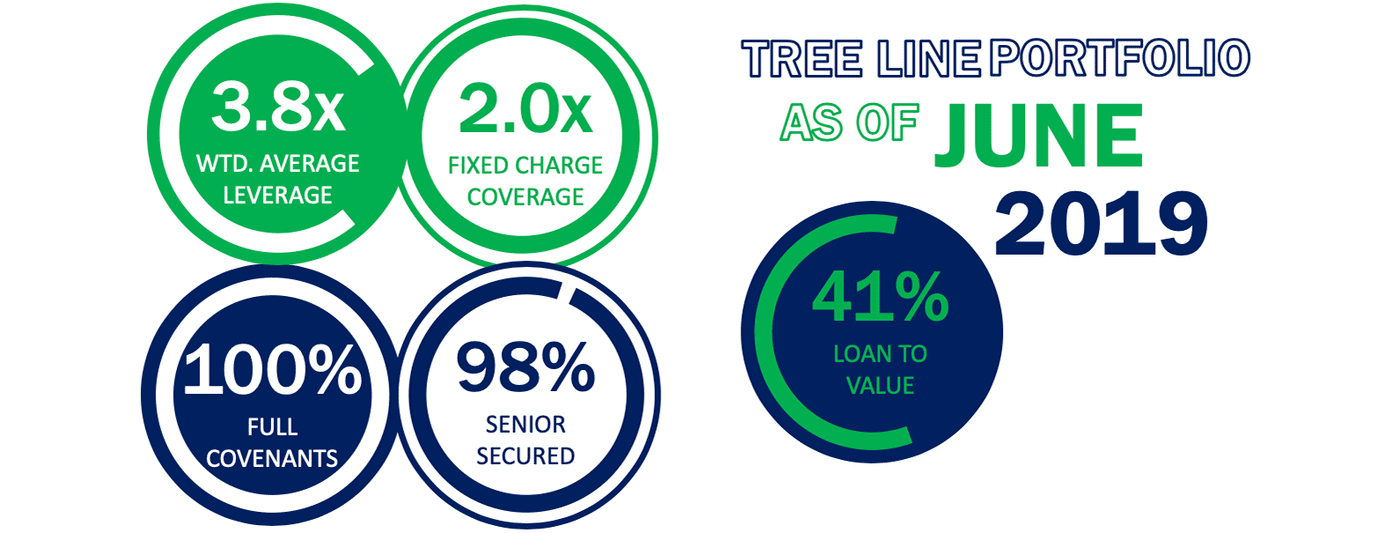

We were direct lenders before, during and after the Great Financial Crisis and have covered the spectrum in terms of company size. We firmly believe there are many other components than size to evaluate to determine a portfolio’s ability to weather a recession. Seniority, leverage, fixed charge coverage, amortization, covenants and a direct relationship all need careful attention to gain a true understanding of a portfolio’s risk.

From the foundation of direct lending that we established at GE Capital to the underwriting ecosystem we have built at Tree Line, we have been Preparing For A Recession since the day we launched the firm. We spend little time forecasting when the next recession will hit and simply assume it will occur in the next quarter. Our portfolio construction strategy favors cycle-durable, high free cash businesses with an ability to withstand economic challenges.

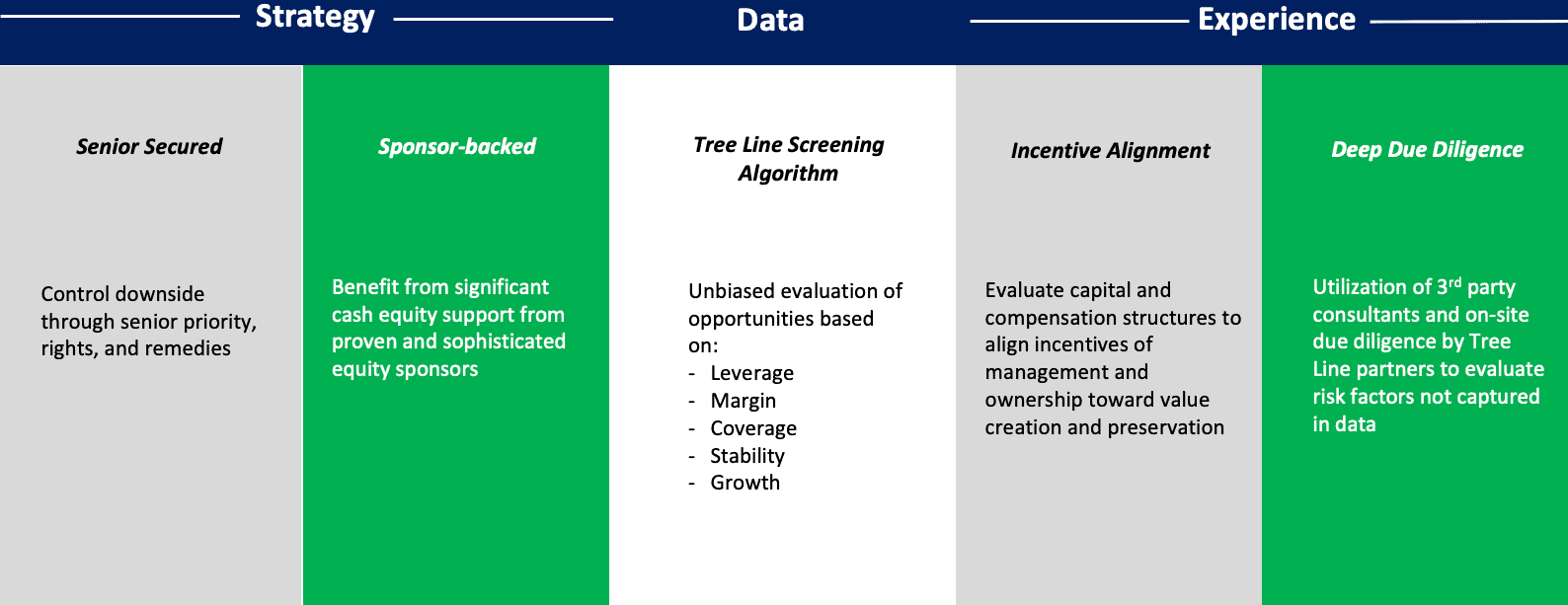

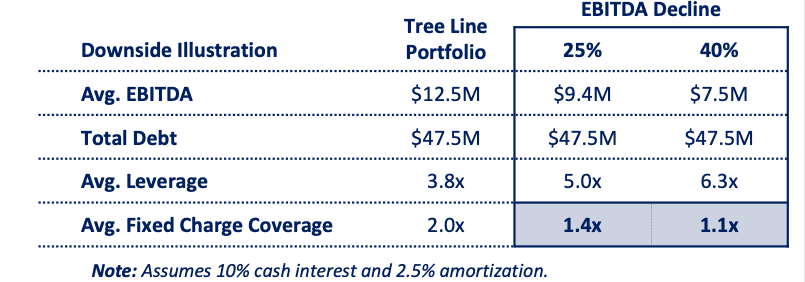

We advise inquiring investors to look beyond simply the size of a company. Peel back the layers of a loan and its structure to truly understand risk-adjusted return. We aim to remove volatility from investor’s portfolios and deliver consistent returns throughout a cycle. We take comfort in our current weighted average leverage of 3.8x, weighted average fixed charge coverage of 2.0x, weighted average loan-to-value of 41% and the significant cash equity from reputable financial sponsors that sits in a first-loss position below us. These metrics are a result of an intensive, direct underwriting process that has been developed over the course of our careers.

Our “Strategy, Data and Experience” approach is at the core of our underwriting ecosystem. A Strategy that is focused on senior secured loans backed by private equity capital provides meaningful rails to keep us on course. We double down with an unbiased assessment of the Data. We look heavily upon the performance metrics of a company with a key focus on leverage, margin, coverage, stability and growth. Lastly, our Experience, that is derived from nearly 20 years of directly sourcing, underwriting and managing loans, is of paramount importance.

This is a relationship business where we develop first-hand relationships with both our sponsors and borrowers. Our 100% direct model works and ensures we understand the people, incentives, strengths and weaknesses at a portfolio company. The direct relationships we forge are critical to both our growth and capital preservation strategy and along with our tremendous team are the most valuable assets we have.

Investing in our platform.

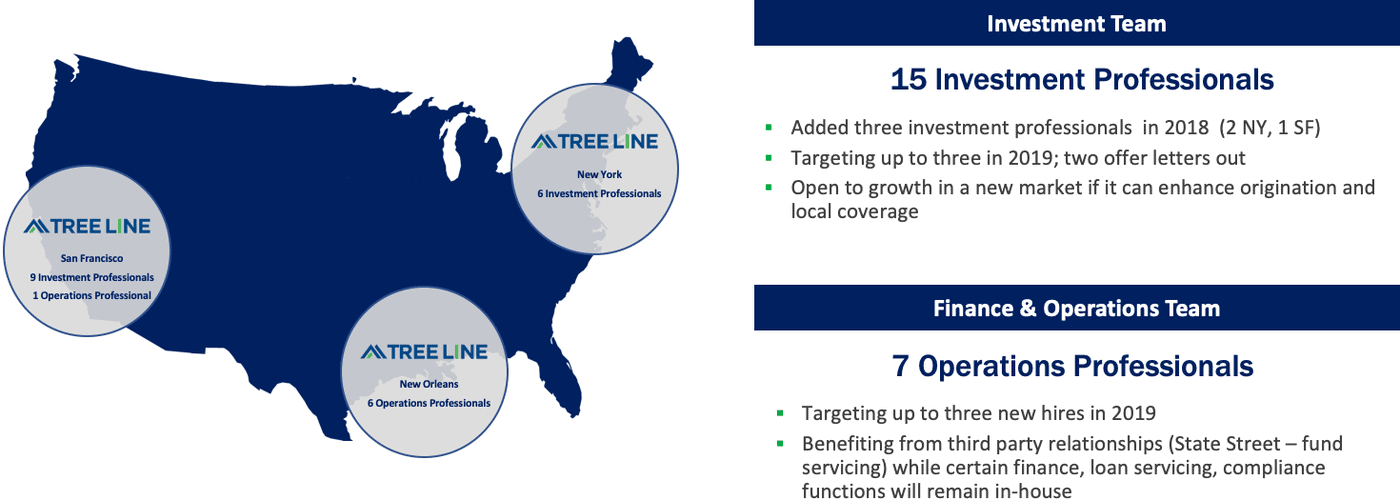

Investing In Our Platform remains a priority as we continue to scale our team, systems and infrastructure. In 2018, we added three

investment professionals and continued to invest in our platform technology. In 2019, that trend will continue.

We are targeting up to five new hires across investing and operations. This year we will invest materially in our platform technology including asset management systems, loan servicing software, an employee intranet and software tools to help our team further collaborate regardless of where they are on any given day.

Tree Line’s market opportunity, team, culture and platform remain incredibly strong. We have the opportunity to be the definitive leader in lower middle-market direct lending. We will leverage our success to date and continue to expand our footprint, prepare for market change and invest in our platform. But more importantly, we will continue to work every day to deliver our investing partners value. We greatly appreciate the support all our investing partners have shown us over the past five years, and we take very seriously the responsibility that comes with managing your capital. We look forward to the work we will do together over the next year.

With appreciation,

Co-Founder & Managing Partner

Co-Founder & Managing Partner

Understanding private credit.

Understanding Private Credit is more important now than ever. The asset class has evolved to a point where one must segment the market to fully understand the underlying opportunities and risks which exist for investors. There are stark differences between the trends of the syndicated loan market, the broader middle-market and the lower middle-market. We continue to lead this conversation with investors sharing our expertise and research on the lower middle-market opportunity.

No end in sight.

Private credit growth drivers remain in place.

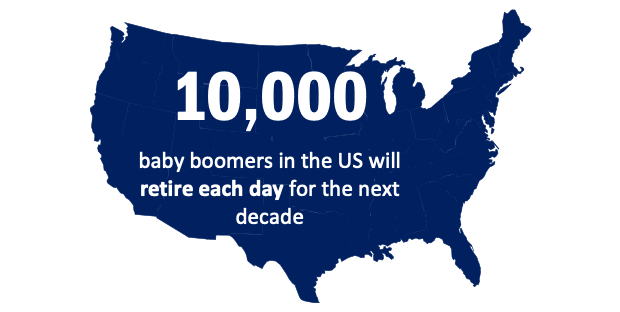

Public and private pension managers are contending with massive unfunded liabilities concurrent with the baby boomer generation reaching retirement age. Accommodative global monetary policy has pushed yields on traditional credit assets to record lows. Private credit has provided an option for those investors in need of premium yield, uncorrelated to public equity markets.

Private credit fundraising has averaged $110B annually since 2014, with direct lending strategies collecting the majority of assets. While private credit represents only 13% of total private market assets, fundraising has outpaced both private equity and private real estate by 1.1% and 4.5%, respectively, on an annual basis since 2013 as investors have continued to seek above-market yields.

We expect these dynamics to continue as investors contend with persistent pension funding gaps (private pension funding gap of $215B in 2018 and state pension funding gap of $1.4T in 2016). These gaps will be exacerbated by accelerating growth in retiree populations as baby-boomers reach retirement age and anemic fixed income returns driven by global monetary policy.

Delivering yield. Driving growth.

Investors turn to private credit.

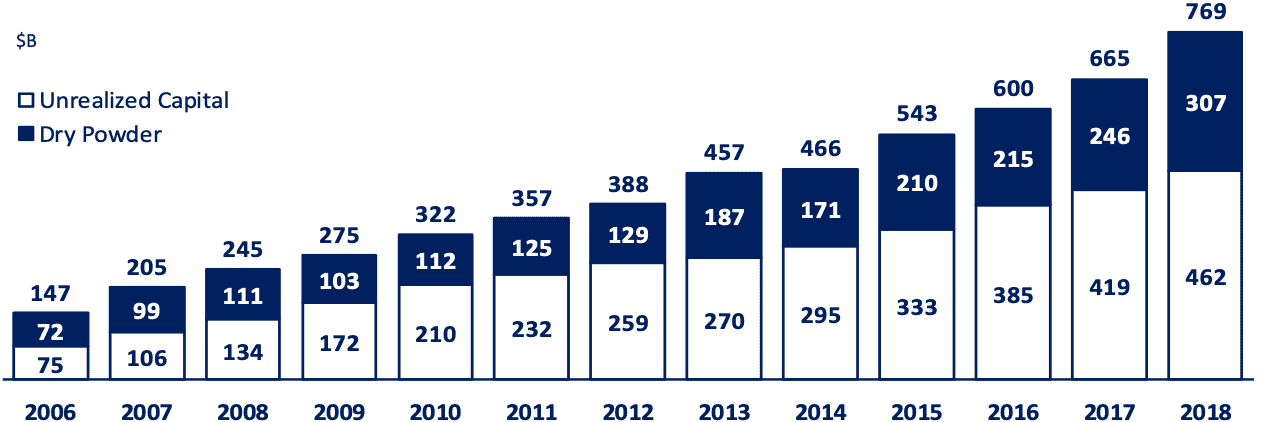

Accumulated private equity dry powder also set a record in 2018 – despite the strongest five-year stretch in buyout dollar-volume in the industry’s history – as capital inflows across the private markets remains robust. While changes in the macroeconomic landscape may impact valuations and deal terms, we expect the record capital overhang in private equity funds to drive strong deal volume – as well as demand for high-yield credit – into the foreseeable future.

Private credit AUM has grown at a 15% CAGR over the past 12 years, outpacing both private equity and real estate.

Focused on yield. Blurry on risk.

The 2018 Broadly Syndicated Loan Market.

Risk on.

Record risk-tolerance in leveraged loans.

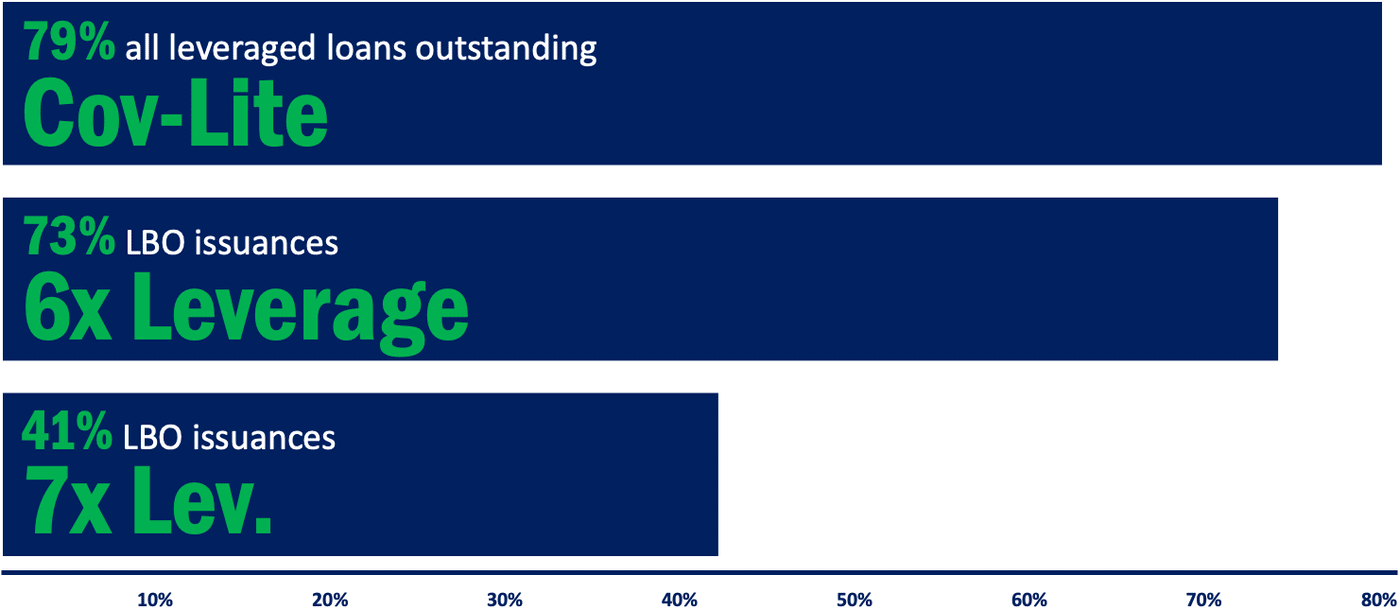

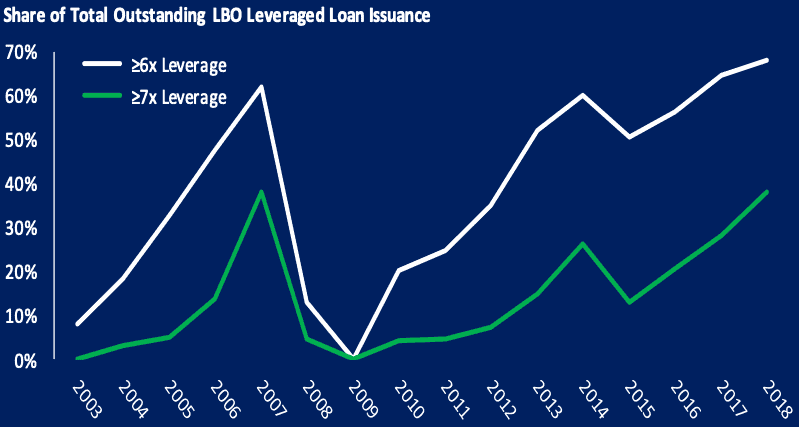

Despite the Leveraged Lending Guidance issued to banks by the OCC in 2013, restricting bank participation in loans with leverage greater than 6.0x, leverage levels in the broadly syndicated loan (BSL) market continue to set new records. Issuance at leverage greater than 6.0x and 7.0x reached record market share levels of 73% and 41%, respectively, during 2018; while the share of loans with no maintenance covenants (cov-lite) also set a new record at 79%. This surge in risk tolerance has been fueled by both institutional and retail investor demand for yield, as combined CLO and Loan Fund assets reached a new record of $770B during 2018, comprising 65% of the BSL market.

Congressional Democrats – along with several industry leaders and Federal Reserve Board governors – have begun voicing concern over climbing leverage levels and deteriorating underwriting standards in the BSL market. Should the “blue-wave” propel Democrats into either (or both) the White House or control of Congress in 2020, industry participants could see tighter controls on risk-taking in the BSL market for bank and non-bank participants alike, at a minimum resulting in increased costs to managers and lower returns to investors. We expect that in the event of increased regulation of the BSL market, issuance (followed by investor capital) would be further shifted into the direct lending market.

Ripped from the headlines.

Middle-market feels pressure to deploy.

Victims of success.

Lending conditions becoming frothy in the middle-market.

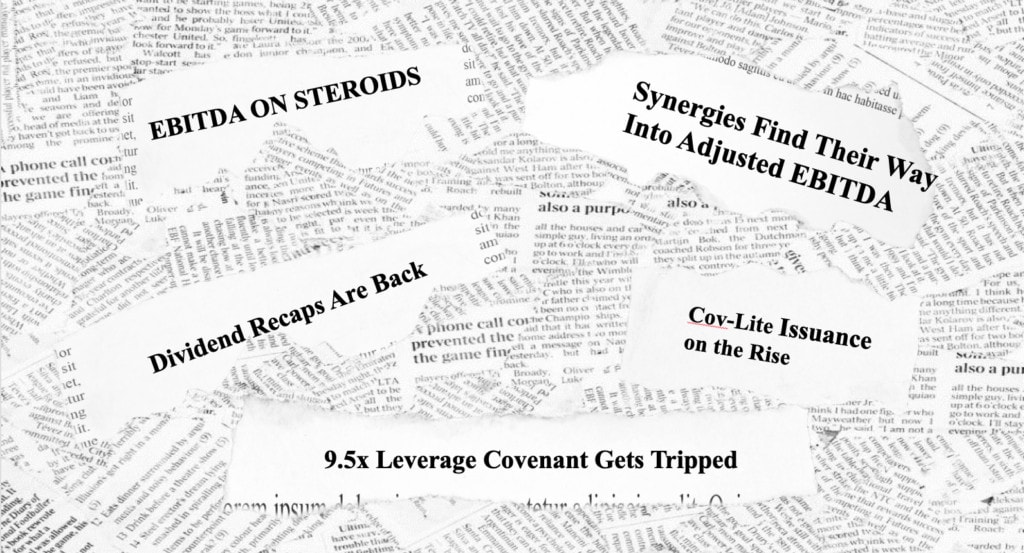

Once a niche assets class, middle-market direct lending has become increasingly competitive as the influx of capital has attracted new entrants and accommodated the rapid growth in AUM for existing managers. Further, as direct lending has matured, pressure from investors to reduce fees has pushed managers into a race for scale. The result has been the commoditization of middle-market lending, with predictable symptoms that have mirrored the leveraged loan market: spread compression, increasing leverage (>5.0x), and deteriorating creditor protections.

We believe middle-market direct lenders are better positioned than their BSL market peers in the event of a recession primarily due to structural reasons, as individual assets tend to be held by a single lender (or a small club) and housed in private funds or BDCs that are not at risk of becoming forced sellers due to investor withdrawals. However, it is safe to assume that the prognosis for the asset class in the event of an economic downturn will be a sharp decline in returns as increased leverage levels across portfolios will create a larger population of non-performing loans and watered-down credit agreements will keep workout teams sidelined longer.

The middle-market perhaps offers the trickiest segment within direct lending to assess. Investors and consultants are lured by platforms managing tens of billions, as comfort often comes in numbers, but scale can be the enemy of discipline. The headlines are now evidence of trends of a market that has significant pressure to deploy. As we enter the 10th year of a recovery and observe the frothy conditions up market, we believe niche and specialized asset classes make a compelling case and deserve real attention.

Digging Deeper. Uncovering Value.

The lower middle-market advantage.

Discipline rewarded.

Alpha delivered.

If we were to characterize the lower middle-market (LMM) in one word it would be “fragmented”. With over 175,000 businesses operating with $10M-100M of annual revenue, the opportunity set for investors in the LMM vastly exceeds that of its up-market peers. The attractive nature of this opportunity is exemplified by the growth of both traditional and independent sponsors in the LMM, with over 950 firms targeting platforms with under $20M of EBITDA.

While sponsors were quick to shift their focus down-market to maximize value, lenders have been slower to respond. As compared to the highly-intermediated and auction-based approach found in traditional middle-market direct lending processes (mirroring the BSL market), sponsor debt-raise processes in the LMM feature a significantly smaller universe of lenders and tend to be highly relationship focused. This inefficiency in LMM debt capital markets creates the opportunity for premium yields, traditional creditor protections, full covenant packages, and consistent repeat and referral deal flow.

Borrowers, sponsors, and management teams in the LMM tend to come in more variable sizes and skill profiles than their up-market peers, making deal selection, due diligence, loan structuring, and active portfolio management each critical skills for successful LMM lenders. At present, the capital constrained lower middle-market creates a relationship-based dynamic that accommodates deep due diligence, with lenders receiving unencumbered access to management and sponsors, as well as full creditor protections and covenant packages. While some larger direct lenders have refocused their attention down-market in recent years – applying pressure on spreads – we have not witnessed the commensurate deterioration of downside protections accepted by our up-market peers.

Disruptive forces. Unique Opportunities.

“Software is going to eat the world”

– Mark Andreesen

Software has become an indispensable tool in the day-to-day functioning of both the private and public sectors, delivering cost-reducing and productivity-enhancing solutions to users across the economy. The wide-spread proliferation of cloud-computing and artificial intelligence-based tools will accelerate adoption and expand wallet-share, driving growth for the foreseeable future.

Given the strong tailwinds in the software sector, it is unsurprising that we have observed steady and growing interest in software and tech-enabled services businesses by private equity sponsors, with software buyouts comprising 15% of total LBO volume in 2018 at historically high valuations.

While valuations and leverage multiples in software buyouts remain the highest across the economy, we believe there are compelling dynamics outside of attractive growth drivers that support both valuation and leverage levels beyond what the market has traditionally supported: high free cash-flow generation (average EBITDA margins over 40%) and cycle durability.

The value of these dynamics was exemplified when software was the sole sector returning an average MOIC of greater than 2.5x across PE portfolios through the Great Financial Crisis.

Software 101.

Investing in software from a credit perspective.

Q: What makes these businesses different?

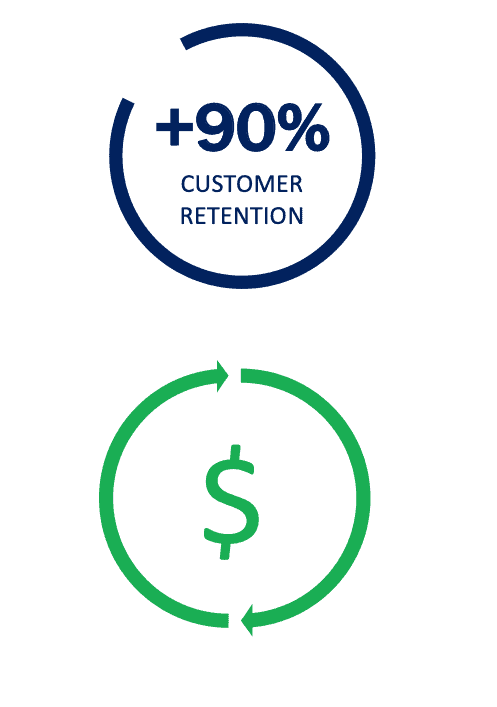

A: Customer Retention.

Enterprise software products are typically deeply embedded into customer workflows and daily operations – with varying degrees of customization – making them challenging and expensive to displace. Providers of best-in-class and/or niche software can often see gross customer retention above 90%.

A: Recurring Revenue.

Strong customer retention combined with subscription-model billing creates a reliable stream of monthly, quarterly, or annual cash income from customers (typically at the beginning of a subscription period).

A: Free Cash Flow.

During the current period of rapid adoption of software products across the economy, owners and managers are often prioritizing growth and market share over margins and profitability (though these businesses still often generate EBITDA margins in excess of 40%). However, if one strips away non-essential sales and marketing expenses and curtails investments in new product development, these businesses can often convert over 50% of their revenue into operating cash flow.

Expanding our footprint.

The size of the lower middle-market, consisting of 175,000 companies with between $10 and $100 million in revenue, is attracting significant private equity attention. We continue to capitalize on this trend and have been Expanding Our Footprint. Year after year the Tree Line brand gains momentum and awareness as a leader in lower middle-market direct lending. To date, we have deployed over $1.1 billion across 80 transactions and have yet to lose a single dollar of principal.

We are the Administrative Agent and/or Lead Arranger on 99% of the deals in our $752M existing portfolio. The Tree Line brand and relationship approach is second to none. Of the capital we have invested to date, 70% has been the result of a repeat or referral relationship. Our borrowers and sponsors choose to work with us, often on a repeat basis, given our long-standing relationships, market reputation for reliable execution and creative credit solutions.

Expanding our footprint.

Tree Line is a relationship lender. We directly work with sponsors and borrowers where a first-hand relationship exists. This approach has been incredibly impactful in the lower middle-market where lending tends to be more specialized, less commoditized and where lenders are selected based on partnership fit and process efficiency rather than pure economics.

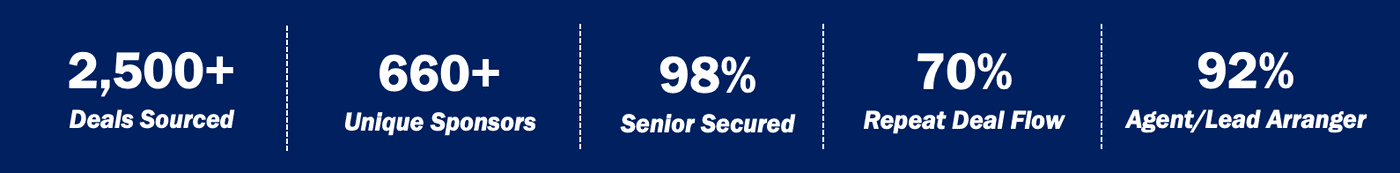

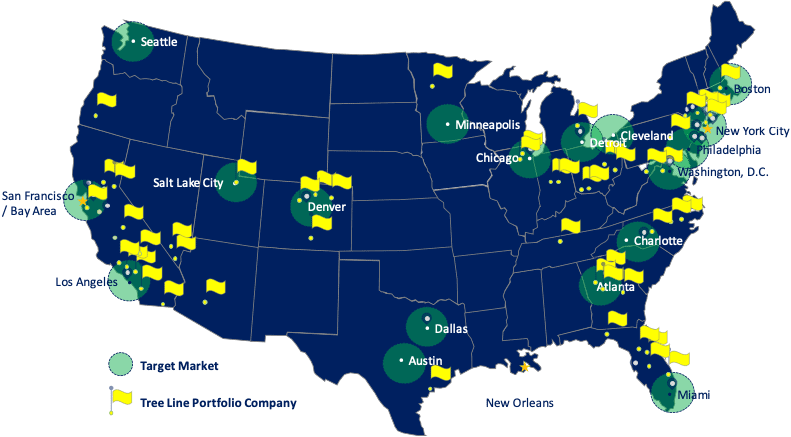

We have invested significantly in our sourcing process to effectively cover the market, which we divide into 18 regional submarkets across the U.S. covered by our eight origination professionals. We utilize a CRM system, which we tailored to our requirements, to enable our team to collaborate and effectively track deal activity across the 600+ deals we see annually. This data-driven approach facilitates relationship maintenance and helps us target active deal sources in our market. We currently monitor 972 sponsors in our system and have seen deal opportunities from over 600 unique sponsors.

Our originators devote substantial in-person time with key sourcing contacts to develop productive relationships that generate last-look opportunities. We are frequently in in the local communities of our sponsors, holding events and attending conferences to ensure we are top of mind.

Our relationship approach is working as we continue to enjoy repeat opportunities, establish new relationships and build a reputation as the go-to lender in the lower middle-market. Driving this brand growth is (i) our strong referral network through which we are often the preferred lender due to a proprietary relationship (70% of our transactions have come through the repeat/referral channel), (ii) demonstrated process efficiency, in which sponsors can rely upon certainty to closing through investment committee involvement and completion of considerable diligence prior to a term sheet, and (iii) our ability to constructively address a wide spectrum of financing needs, from borrowers which need an initial platform loan of $10M to those requiring facilities up to $150M for growth and acquisitions. In 2018, we closed deals with eight new sponsor relationships and six of them have already delivered Tree Line a second deal or follow-on opportunity. For the first half of 2019, we expect to achieve record origination with $310 million across 17 deals.

Our sourcing platform and reach into our market has never been stronger and deeper. We expect this momentum to carry us into the second half of the year and well into the future.

Sincerely,

Frank Cupido

Partner

Leading the Lower Middle-Market.

If it were easy, everybody would do it.

Tree Line has established a national footprint with offices in San Francisco, New York and New Orleans. We have eight originators covering 18 markets in the U.S. reaching Tier I and Tier II cities. To date, we have sourced deals from 12 of our 18 markets and have had great success in Tier II cities receiving less attention, such as Denver, Detroit, Salt Lake City and Minneapolis. As lower middle-market private equity firms move and form outside of Tier I cities such as New York and San Francisco, we are focused on having direct coverage in these areas with a local approach.

Highly selective.

Our portfolio has a lower acceptance rate than Harvard and the US Navy SEALs.

Tree Line has deep reach into the lower middle-market as a result of the team’s career long efforts in covering the opportunity set. The lower middle-market requires a specialized approach and tremendous coverage effort. The market segment is comprised of nearly 1,000 private equity funds that span from long-term successful platforms to independent sponsors. At Tree Line, we believe not all sponsors are created equally and the sponsor selection process requires real attention. Our sponsor selection process has predominantly been based on the following five factors:

• Strategy

• Culture & Values

• Performance and Track Record

• Available Resources, and

• Tree Line Experience in a Challenging Situation.

These factors have proven to be critically important and many have been derived from past experiences. The lower middle-market requires a dedicated approach to get the necessary repetitions to understand the strengths and weaknesses across this market. We believe it would be virtually impossible to replicate these experiences as a newcomer to the market or through a software model.

Tree Line has reviewed opportunities from over 600 unique private equity sponsors and yet has only closed transactions with 30. While the quality and sophistication of lower middle-market sponsors has never been stronger, we take comfort in the fact that we can be highly selective.

Relationships matter.

Because you can’t buy alpha in an auction.

At Tree Line, we focus on developing strong relationships that allow us to work directly with sponsors and management teams to perform deep due diligence and directly negotiate transactions. We believe honesty and transparency are worth more than a few basis points, and our transaction partners seem to share those feelings.

Always the first call.

Add-on acquisitions. Expansion capital. Refinancing.

Since inception, we have closed over $180M in follow-on financings across 23 transactions.

Recent Deals See All Deals

April 2019

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

April 2019

Agent & Sole Lender

First Lien Term Loan & Revolver

A Portfolio Company of

April 2019

Agent & Sole Lender

First Lien Term Loan & Revolver

A Portfolio Company of

February 2019

Agent & Sole Lender

First Lien Term Loan & Revolver

A Portfolio Company of

December 2018

Agent & Sole Lender

First Lien Term Loan & Equity Co-Investment

A Portfolio Company of

December 2018

Agent & Sole Lender

First Lien Term Loan & Equity Co-Investment

A Portfolio Company of

October 2018

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

October 2018

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

September 2018

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

September 2018

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

July 2018

Agent & Lead Arranger

Unitranche Last-Out Term Loan & Equity Co-Investment

A Portfolio Company of

May 2018

Agent & Sole Lender

First Lien & Equity

A Portfolio Company of

April 2018

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

March 2018

Lender

Unitranche Term Loan - Last Out

A Portfolio Company of

December 2017

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

December 2017

Agent & Lead Arranger

Unitranche Term Loan & Equity

A Portfolio Company of

December 2017

Agent & Lead Arranger

First Lien Term Loan & Equity

A Portfolio Company of

November 2017

Agent & Sole Lender

First Lien Term Loan, Convertible Debt & Equity

A Portfolio Company of

November 2017

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

October 2017

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

September 2017

Agent & Sole Lender

Unitranche Last-Out Term Loan

A Portfolio Company of

September 2017

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

March 2017

Agent & Sole Lender

Add-On Acquisition

A Portfolio Company of

January 2017

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

December 2016

Agent & Sole Lender

First Lien Term Loan & Equity Co-Investment

A Portfolio Company of

December 2016

Agent & Sole Lender

Unitranche Term Loan - Last Out

A Portfolio Company of

August 2016

Agent & Sole Lender

Unitranche Term Loan

Non-sponsored

July 2016

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

July 2016

Agent & Sole Lender

First Lien Term Loan

Non-sponsored

June 2016

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

June 2016

Agent & Sole Lender

Unitranche Term Loan

Non-sponsored

April 2016

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

March 2016

Agent & Lead Arranger

First Lien Term Loan

A Portfolio Company of

January 2016

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

November 2015

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

September 2015

Agent & Sole Lender

Unitranche Term Loan

A Portfolio Company of

July 2015

Agent & Sole Lender

Unitranche Last-Out Term Loan

Non-sponsored

March 2015

Agent & Sole Lender

Unitranche Term Loan

A Portfolio Company of

December 2014

Agent & Sole Lender

First Lien Term Loan

A Portfolio Company of

Preparing for a recession.

Amidst all the activity in private credit 10 years into a recovery, the most common question we hear when talking to investors is how will our portfolio fare in the face of a recession. Won’t lower middle-market companies fall on harder times? Aren’t they less likely to survive a downturn? Shouldn’t I look to invest in a portfolio of companies with EBITDA greater than $50M? We were direct lenders before, during and after the Great Financial Crisis and have covered the spectrum in terms of company size. We firmly believe there are many other components to evaluate to determine a portfolio’s ability to weather a recession. Seniority, leverage, fixed charge coverage, amortization, covenants and a direct relationship all need careful attention to gain a true understanding of a portfolio’s risk. From the foundation of direct lending that we established at GE Capital to the underwriting ecosystem we have built at Tree Line, we have been Preparing For A Recession since the day we launched the firm.

An underwriting ecosystem.

Consistent. Reliable. Disciplined.

Our underwriting ecosystem drives consistency and emphasizes capital preservation in all phases of a cycle. Our culture, including our originators, consists of credit professionals to ensure we speak with one voice and with one goal in mind: No losses.

Disciplined. Consistent.

As credit investors, we never lose focus of the fact that we are not playing for the upside. Our rigorous deal selection and underwriting processes are designed to identify and minimize downside risk.

We believe in seniority, covenants, cycle-durable businesses, sensible structures, and the alignment of interests. We believe the impact of losses far outweighs the benefits of rapid deployment. We believe fourth-quarter buzzer-beaters and bottom-of-the-ninth walk-offs are better left for sports history and venture capital.

Sector selection.

Targeting high free cash flow, cycle-durable businesses. Avoiding low-margins and capital intensity.

Business Services

Strategy: Target market leverage, contracted recurring revenue, and limited capex. Avoid project-based work tied to one-time events and large customer concentrations.

Consumer

Strategy: Target market leverage with attractive margins, non-cyclical demand, diversified sales channels and equity tag opportunities. Avoid retail exposure, directly and indirectly through brick & mortar customer relationships.

Healthcare Services

Strategy: Target healthcare providers, service providers, and consumables with non-cyclical demand. Avoid public payor reimbursement risk.

Niche Manufacturing

Strategy: Target long established companies with low leverage and high amort to counter industry cyclicality. Avoid low margin and high capex platforms.

Tech-Enabled Services / Software

Strategy: Target subscription-based recurring revenue with high margins (free cash conversion) to offset higher leverage. Avoid hardware and unproven software products that lack scale and diversification.

Financial Services

Strategy: Target tech-enabled service providers with high switching costs and diversified customers. Avoid regulation, capital intensity and strategies subject to disruption or substitute products.

Downside protection

Prioritizing free cash flow to withstand a shock.

Our underwriting ecosystem and portfolio construction strategy favors and selects companies that can withstand meaningful declines in cash flow.

We would be remiss if we didn’t emphasize the strength and durability of our portfolio companies. The lower middle-market is a critical component to our economy and the businesses that comprise this market segment are embedded in our economy’s supply chain, services and products. There is a misnomer in the market that lower middle-market companies can simply go away. Yes, some surely can but we don’t believe that characterization necessarily is limited to this market segment. What’s more important to us is the underlying attributes of a company. We value companies that maintain recurring or visible revenue that sell on a subscription or contract basis and generate high free cash flow. Companies entrenched within a customer’s processes which deliver a required service or product results in a high switching cost and reduces the risk of customer attrition. We sift through over 600 companies per year to construct a portfolio that is designed to withstand economic volatility.

Investing in our platform.

Investing In Our Platform remains a priority as we continue to scale our team, systems and infrastructure.

In 2018, we added three investment professionals and continued to invest in our platform technology and in 2019 that trend will continue. Tree Line’s market opportunity, team, culture and platform remain incredibly strong. We have the opportunity to be the definitive leader in lower middle-market direct lending.

Investing in our platform.

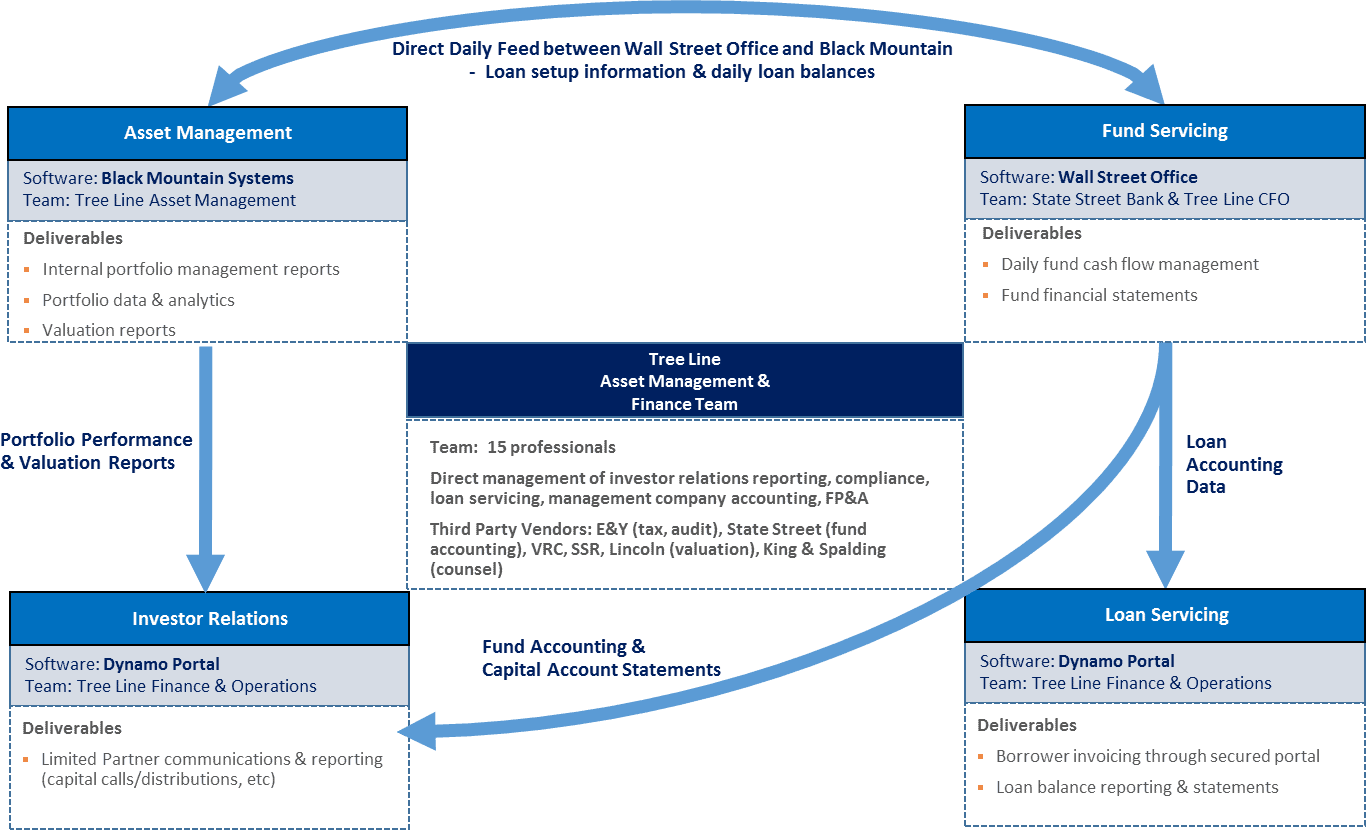

At Tree Line, we prioritize the continued investment in our team, platform and culture. Our investment and operations team continue to expand staying one step ahead of our platform’s growth. Year after year we invest further in our existing systems to extract more value while identifying new systems to be integrated into our suite of technology products.

As the SVP of Finance, I work closely with our third parties that deliver us a core competency in fund servicing, audit, tax and valuation. Our goal is to partner with best-in-class service providers that can deliver us scalable solutions that interface seamlessly with our operations team. Our team in New Orleans will continue to grow to provide dedicated support to the investment activities of our firm. We have worked hard over the past five years to identify, establish and nurture processes and systems that are designed for scale.

Creating a system and technology that enables our fund servicer, State Street Bank, to directly interface with our asset management system, Black Mountain Systems, has been extremely impactful to increase the speed and accuracy to consume information across the team.

In today’s world, we must be on the forefront of compliance and cyber-security issues. We have taken great deal of time to design an IT infrastructure that is modern and agile to our needs in today’s environment. We have implemented a series of proactive steps to ensure we mitigate risk and maintain best practices. We are also tapping the best tools available to keep our team collaborating and connected. Utilizing Slack, SmartSheet and an employee intranet are just a few tools that keeps our team connected regardless of location on any given day.

We are excited about the work we have done to date to build our platform to scale but our focus will remain on the future. We will continue to invest in Tree Line to ensure our investors, borrowers, employees and funds are supported by best-in-class technology solutions.

Dave Huston

SVP of Finance

Our story

Thoughtful expansion.

A National footprint.

Building lasting relationships face to face.

Winning Team.

Collaborating daily through technology and culture.

Built for scale.

A platform running on technology.

Tree Line has invested meaningfully in its operations platform and technology solutions that support it. We have procured software and established relationships with best-in-class service providers to connect our team, borrowers and investors. We currently have an operations platform that is interconnected through software solutions to ensure a seamless transfer of data and information.

Disclaimer

Opinions

Opinions expressed are those of Tree Line Capital Partners, LLC as of June 2019 and are subject to change.

Tree Line data points

Company data reflects YTD 2019 results proforma for the second quarter or as of December 31, 2018, unless otherwise noted.

The information provided herein with respect to Tree Line funds has been provided for informational purposes only and does not constitute an offer to sell, or solicitation of offers to buy or convert, securities in Tree Line funds or any other existing or to be formed issuer. Investments in a number of Tree Line funds can be made only pursuant to the subscription agreement, confidential private offering memorandum and related documents and after careful consideration of the risk factors set forth therein.

An investment in Tree Line funds is speculative and involves a high degree of risk, including risks related to the use of leverage. The performance of Tree Line funds and its investments may be volatile. An investor may lose all or a significant amount of its investment. It is anticipated that there will be no secondary market for such interests and, in the event that an investor is unable to redeem its interests, the interests will be illiquid. Further, such interests will be subject to legal and contractual restrictions on transfer. The performance of debt investments could be adversely affected if the issuers of the instruments default or if events occur that reduce the creditworthiness of those issuers. If a note or other debt instrument were to become subject to such an event, the value of the instrument could be significantly reduced, conceivably to zero. Investment in such interests is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risk and lack of liquidity inherent in the investment.

This presentation contains forward-looking statements relating to the plans, objectives, opportunities, future performance and business of Tree Line Capital and the future performance of the debt markets in North America generally. Statements regarding anticipated returns, forecasts and projections rely on a number of economic and financial variables and are inherently speculative. Forecasts relating to market conditions, returns and other performance indicators are not guaranteed and are subject to change without notice. Forecasts are based on complex calculations and formulas that contain substantial subjectivity and no express or implied prediction is made hereby with respect to Tree Line funds. There can be no assurance that market conditions will perform according to any forecast or that Tree Line Capital will achieve its objectives or that investors will receive a return of their capital. Target returns are based on a number of assumptions related to the market factors relevant to the proposed investment strategy, including, but not limited to, interest rates, supply and demand trends, and the terms and costs of debt financing. Further, past performance is not indicative of future results. Investors are cautioned not to place undue reliance on any forward-looking statements or examples included in this presentation and neither Tree Line Capital nor Enhanced Capital assumes any obligation to update any forward-looking statements.

The information herein includes targeted yields and internal rates of returns (“IRR”), which are based on a variety of factors and assumptions and involves significant elements of subjective judgment and analysis. Targeted yields and IRRs are being presented because they provide insight into the level of risk that Tree Line Capital is likely to seek with respect to the relevant product. The targeted yields and IRRs are a measure of relative risk of a portfolio of investments, with higher targets reflecting greater risk. Targeted yields and IRRs are estimates based on a variety of assumptions regarding, among other things, current and future asset yields for such investments and projected cash flows related thereto, current and future market and economic conditions, prevailing and future interest rates, including the cost of use of leverage, where applicable, historical and future credit performance for such investments, and other factors outside of Tree Line Capital’s control. The targeted yields and IRRs are subject to uncertainties and are based upon assumptions which may prove to be invalid and may change without notice. Other foreseeable and unforeseeable events, which were not taken into account, may occur. Investors should not rely upon the targeted yields or IRRs in making an investment decision. Although Tree Line Capital believes there is a sound basis for such targets, no representations are made as to the accuracy of such targets, and there can be no assurance that such targets will be realized or achieved. Additional information concerning the assumptions used in connection with the target returns is available upon request.

To the extent specific securities are referenced herein, they have been selected by Tree Line Capital on an objective basis to illustrate the views expressed in the material. Such references do not include all material information about such securities, including risks, and are not intended to be recommendations to take any action with respect to such securities. Neither Tree Line Capital nor Enhanced Capital are responsible for any damages or losses arising from any use of this material.

This presentation is for the confidential use of only those persons, and their advisers, to whom it is transmitted by Tree Line Capital and, without the prior written consent of Tree Line Capital, may not be reproduced, distributed to others or used for any other purpose.